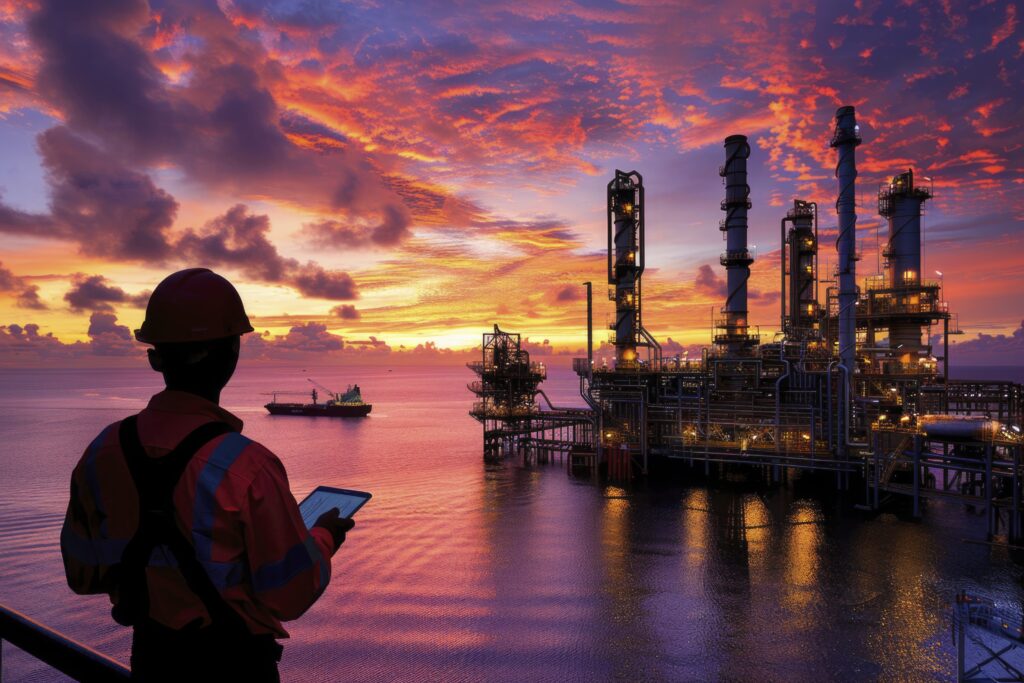

Mexican export cuts and a rerouting of Canadian output are shrinking already limited supplies of heavy crude in the Atlantic basin, driving up refiners’ costs with a likely knock-on effect to industries ranging from shipping and construction to Middle Eastern power plants.

Prolonged OPEC supply cuts and international sanctions on Venezuela, Iran and Russia had already led to shortages of heavier crude, with the complex refineries built to process it, such as those in the U.S. Gulf, struggling to find cheap supplies.

Heavy-sour crudes yield more residual fuel oils that are either upgraded into higher-value road fuels, or converted into marine fuels and bitumen.

More marine fuel oil is needed by ships making longer voyages around Africa to avoid the Red Sea area, while in summer Saudi Arabia burns more fuel oil for air conditioning and demand also increases from higher construction and road-laying activity.

Mexico cut crude exports in April to facilitate higher domestic processing as it seeks to end a costly dependency on fuel imports. That further threatened sour supply in the Atlantic basin where refiners have been preparing for the opening of the Trans Mountain pipeline expansion which will divert more heavy Canadian crude to the Pacific.